Brussels Tax Hike to send E-Cigarette Prices Soaring

Originally Published in The Times March 2nd 2016

Electronic cigarettes are set to soar in price under plans by Brussels to tax them at the same punitive rate as tobacco.

Vaping will be brought into line with cigarettes and cigars as the EU tries to help governments to raise more money.

Experts say that a tax rise will damage public health because higher prices will discourage smokers from switching to vaping. A report published yesterday shows that in Britain about 20,000 smokers a year give up because of e-cigarettes — as many as quit through all other stop-smoking aids combined.

However, ambassadors from all 28 EU countries have agreed to take the first steps towards imposing higher duty, quietly telling the European Commission to come up with plans by next year to reclassify e-cigarettes as tobacco products for tax purposes.

It comes as pharmaceutical companies lobby for stricter rules, worried by the competition for their patches, gums and other nicotine replacements.

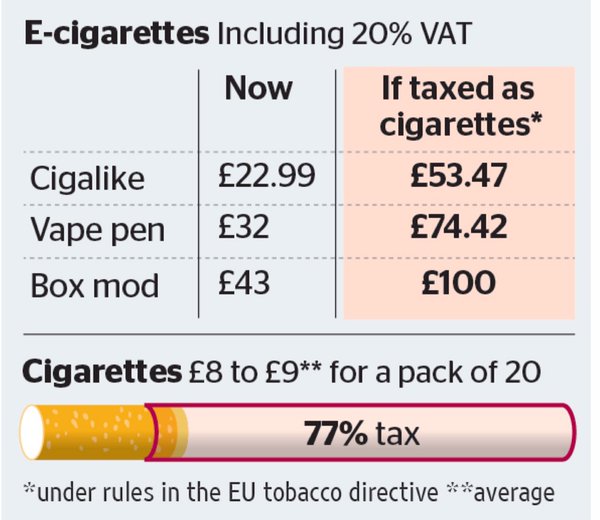

The present excise regime means that duty must make up at least 57 per cent of the retail price of a packet of cigarettes. VAT makes up 20 per cent, taking the total tax burden to at least 77 per cent. E-cigarettes are subject to 20 per cent VAT. Their prices vary but a cartridge costing between £1.50 and £5 is roughly equivalent to a £10 packet of 20 cigarettes.

Many smokers who have turned to vaping say that their spending has halved. A levy could wipe out this saving.

Deborah Arnott, of the health charity ASH, said: “If the EU were to require states to tax electronic cigarettes like tobacco products it would be detrimental to public health. It would discourage smokers from switching.”

About 2.2 million people in Britain use e-cigarettes to get their nicotine fix without the tobacco that causes cancer. They contain a nicotine-based liquid that is vaporised and inhaled.

PublicHealth England estimates that they are 95 per cent less harmful than cigarettes and has urged the NHS to recommend them. Many doctors and public health experts remain sceptical, however, and have pushed for tougher regulation.

Lorien Jollye, a vaping activist, said that a tax rise would put people off quitting cigarettes. “There is something very unsettling about financially punishing people for giving up smoking,” she said.

In December the European Commission recommended developing plans for “including e-cigarettes in the scope of excise duty on tobacco products”, warning that a failure to act “might have significant longterm budgetary implications for member states”.

Last week the European Council agreed the need to consider creating a category for e-cigarettes in the tobacco tax directive. Officials will now decide what level of excise duty should apply to them.

In a decision to be ratified by EU finance ministers on Tuesday, the ambassadors said that the move was needed “to reduce legal uncertainty, hamper substitution by borderline products and avoid possible different approaches in member states”.

In the US three states now tax e-cigarettes: North Carolina and Louisiana, which charge five cents per millilitre of fluid, and Minnesota, where the tax rate is 95 per cent of the wholesale price of each tobacco product. Kansas has passed a tax that comes into effect this summer, with a rate of twenty cents per millilitre.

Asked whether the move would bring higher e-cigarette prices, an EU spokesman said it was self-evident that it would. The plans will go to public consultation, setting up a lobbying battle.

A previous tobacco projects directive was called “the most lobbied dossier in the history of the EU”.

Pressed for details on price rises, a second spokesman said: “It is too early to say what effect the review of this directive could be.”

Under those rules, which come into effect in May, e-cigarettes not licensed as stop-smoking medicines will be limited in size and strength, with advertising banned.

Tobacco companies, led by Philip Morris International, tried to water down the tobacco products directive, while pharmaceutical giants, led by GlaxoSmithKline, sought tougher laws.

Olivier Hoedeman, from Corporate Europe Observatory, a pro-transparency NGO, said “evidence indicates” that the GlaxoSmithKline campaign was less effective. Of the excise duty proposal, he added: “It would be quite awkward to put e-cigarettes in the same category [as other tobacco pro- ducts] if the science isn’t there yet.”